Zielona energia dla Twojego domu

Polenergia Sprzedaż

Czas przejść na zieloną stronę mocy i korzystać tylko z czystej, zielonej, odnawialnej energii.

Budujemy

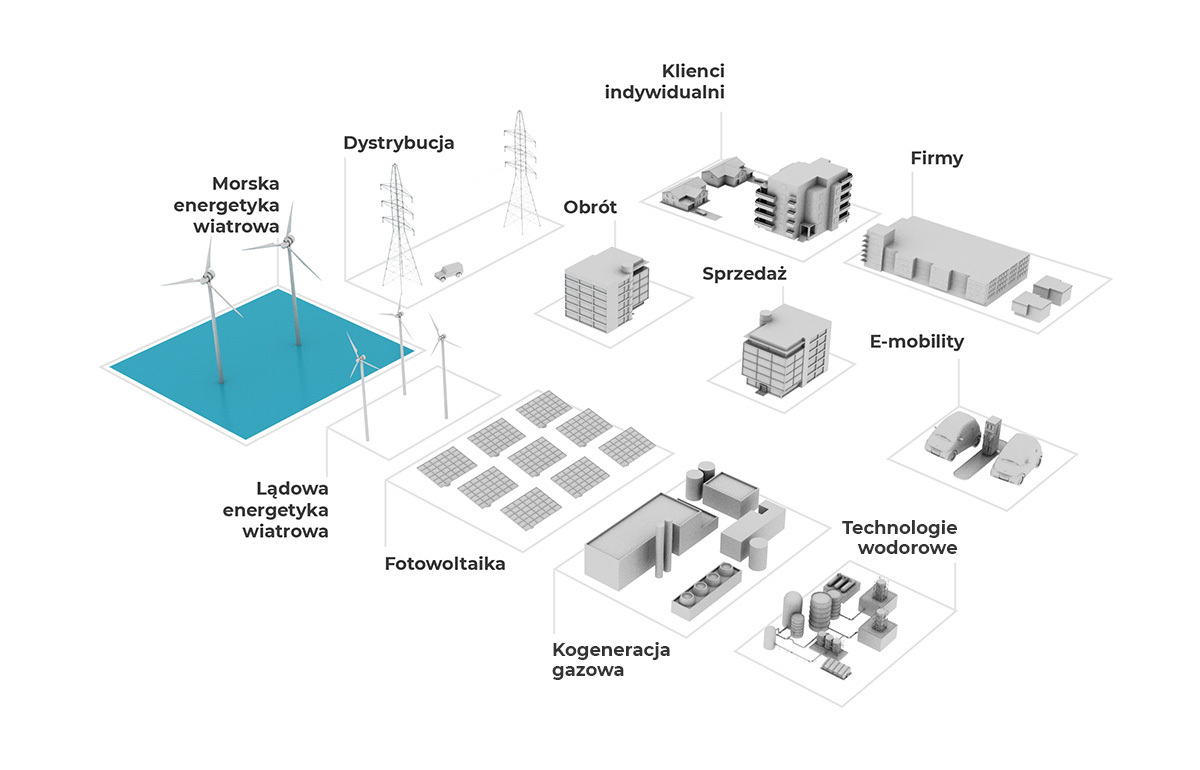

zeroemisyjną gospodarkę

poprzez działania w ramach wszystkich ogniw naszego modelu biznesowego – wytwarzania, dystrybucji, obrotu i sprzedaży.

WięcejRozwijamy

energetykę wiatrową na morzu

Łączna moc projektów rozwijanych przez Polenergię we współpracy z Equinor sięga 3000 MW.

WiecejZwiększamy

zielone moce na lądzie

Nowoczesne farmy wiatrowe i fotowoltaiczne o łącznej mocy 530 MW to jeden z kluczowych elementów naszego modelu biznesowego.

WięcejUczestniczymy

w transformacji wodorowej

Wykorzystamy potencjał wodoru jako paliwa przyszłości, surowca a także akumulatora energii wytwarzanej przez nasze zielone aktywa.

WięcejDbamy

o zrównoważony rozwój

Nasz wyjątkowy, zielony model biznesowy to nie tylko sposób realizacji misji Polenergii, ale także świadomy wybór biznesowy.

WięcejNasz model biznesowy obejmuje wszystkie elementy energetycznego łańcucha wartości – od wytwarzania do bezpośredniej sprzedaży kierowanej do odbiorców biznesowych i indywidualnych. Segmenty te tworzone były w oparciu o odmienne założenia niż w przypadku innych krajowych grup energetycznych – w oderwaniu od historycznych uwarunkowań i obciążeń.

Dzięki temu, że wybiegamy w przyszłość, oferta Polenergii już dzisiaj spełnia wymagania Europejskiego Zielonego Ładu, które obowiązywać będą wszystkie przedsiębiorstwa sektora za ponad ćwierć wieku. Przyglądając się naszej Grupie, w wielu aspektach, można dowiedzieć się, w jaki sposób będzie wyglądał sektor energetyczny po roku 2050.

Szanowny użytkowniku, w zgodzie z założeniami RODO potrzebujemy Twojej zgody na przetwarzanie danych osobowych w tym zawartych w plikach cookies. Dowiedz się więcej.

The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. If you continue to use this website without changing your cookie settings or you click "Accept" below then you are consenting to this.